There are many costs to think about when it comes to buying a home. The most obvious one is, of course, the house itself, but there are also lots of other charges you might not have thought about yet. One of these is Land Transaction Tax.

What is Land Transaction Tax in Wales?

The new LTT system was announced by the Welsh Government in the October 2017 Budget and came into force in April 2018.

LTT is payable when you buy or lease a building or land over a certain price. The new LTT taxation system is broadly consistent with the existing SDLT structure in England and Northern Ireland.

The changes are designed to make the new tax fairer, improve taxation effectiveness and to enable a focus on Welsh needs and priorities.

How much is it?

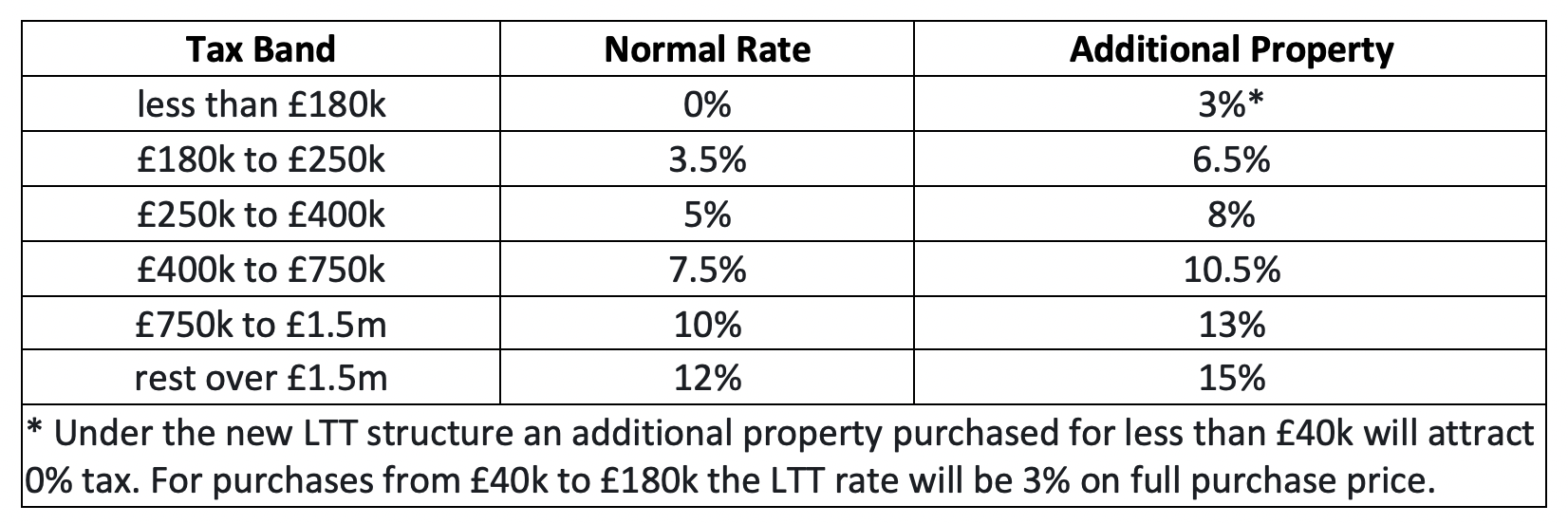

For a normal purchase LTT is exempt on the first £180,000. Between £180,000 and £250,000 buyers will pay 3.5% within this band, 5% on the portion between £250,000 and £400,000, 7.5% on the portion between £400,000 and £750,000, 10% within the next band up to £1.5 million and 12% over that. For additional property, such as buy to let or second homes, there will be a 3% surcharge applied to all bands.

To work out exactly how much LTT you will pay on a property you are interested in, check out the calculator below

https://www.stampdutycalculator.org.uk/ltt-calculator.htm

Alternatively, if you require any further information contact our in-house financial advisor Suzanne who will be able to advise you on all aspects of Land Transaction Tax, mortgages, and insurance

Contact us today on 01443 808 808 or email us at info@dylandavies.co.uk

Posted on: 6 July 2020